When winter weather insurance claims start arriving, your adjusters need to verify and settle them quickly. Here are the top 7 winter weather terms your team may encounter this winter and what they mean for your policyholders.

1. Snow vs. freezing rain vs. sleet

Snow occurs when water vapor freezes in the clouds and forms crystalline structures without ever becoming liquid; this is fundamentally different from freezing rain and sleet, both of which transition through water. Sleet particles are ice pellets that form when partially melted snow and ice refreeze before reaching the ground. Freezing rain occurs when snow and ice completely melt in the atmosphere, fall to the ground and refreeze on impact. The type of precipitation you get depends on whether the temperatures are above freezing between the clouds and the ground, and how deep that warm layer gets.

For carriers, the difference is critical: Snow can mean everything from roof collapses to car accidents; sleet comprises frozen drops that bounce off surfaces and can cause slips; and freezing rain glazes cars, trees, power lines, roofs, etc. with a thin sheet of slippery (and heavy) ice, causing potentially significant and costly property damage and liability risk.

2. Bombogenesis

More commonly known on news reports as a “bomb cyclone,” this weather phenomenon refers to the rapid intensification of a cyclonic storm, most often found moving up the East Coast. When a cold air mass collides with a warm air mass over the Atlantic Ocean, this causes a decrease in air pressure. With bombogenesis, the air pressure drops so significantly so quickly that strong winds whip up, triggering massive amounts of heavy rain and snow.

For insurers with properties in the path of a storm undergoing bombogenesis — most often a nor’easter — special attention should be paid to wind speeds, temperatures and precipitation amounts, as all are primed to hit intense levels quickly. This combination can cause roof damage and collapses, and even potentially flash freezes.

3. Nor’easter

Excessive snowfall, cold temperatures and high winds – these are all hallmarks of a nor’easter. This type of storm occurs in the northeastern U.S. and is fueled by the difference in temperature between arctic air that sweeps across the country and maritime air swirling over the Gulf Stream. This extratropical storm’s cyclonic winds move counter-clockwise, bringing warm, moist air inland while cold air swirls in from the northwest. Winds whip up with the lack of resistance over the ocean, increasing the risk of coastal flooding from storm surge (especially dangerous during the winter months) while massive amounts of rain and snow fall on land.

Nor’easters are among the most expensive winter storms in terms of claims for their incredible ability to deliver heavy amounts of snow and rainfall, storm surge flooding and freezing temperatures that can cause icing and property damage.

4. Lake-effect storms

Warm water and cold air combine to create intense snowfall in the Great Lakes region in a phenomenon known commonly as “lake-effect snow.” As cold air passes over the relatively warm lake waters, the surface water evaporates and rises with the warmer air. As it cools, this moisture-dense airmass freezes and creates precipitation, most commonly in the form of snow. With the fuel of the lake water, storms or even just cold air masses that naturally pass over the Great Lakes regions, can produce massive amounts of snowfall for cities like Chicago, Buffalo and Syracuse – with snowfall totals measured in feet instead of inches.

For insurers, exposures within range of this lake effect are more likely to receive heavy snowfall P&C claims due to the moisture in the air and frigid temperatures coming down from Canada.

5. Thundersnow

Thundersnow is the rare meteorological phenomenon that occurs during snow storms specifically near bodies of water, like lakes and on the coast, when warm air from the water is pushed upward to form very intense snow bands. The thunder itself is indicative of very heavy snowfall, yet the sound can be difficult to hear with the dampening effects of the snow.

Its impact on insurers is a bit of a mixed bag: While thunder is just a sound, the accompanying heavy snowfall can cause damage, and any associated lightning can lead to property damage and fires.

6. Alberta clipper

Also known just as “clippers,” these fast-moving storms are named after clipper ships for their speed. They are formed when a low-pressure system originating in Alberta (or nearby regions) is quickly picked up by the jet stream and brought southeast through the Northern Plains, Great Lakes and eventually Northeast. They generally do not carry much moisture and move too quickly to bring heavy snowfall, but can bring very cold air and strong wind gusts of up to 60 mph.

For insurers, wind damage is the biggest threat with Alberta clippers, but dry, whipping snow and whiteout conditions are possible. Watch for downed tree limbs and power outages, followed by possible periods of intense cold.

7. Polar vortex

Polar vortexes are anti-cyclones of frigidly cold air that swirl high up in the atmosphere around the poles all year. In the winter, the North Pole’s vortex can expand, with portions dipping into the U.S., causing arctic air to plunge southward.

For insurers, polar vortexes themselves are not necessarily dangerous to properties, but they can bring freezing conditions that might require property insurance claims to be processed more quickly. When window, roof and other structural damage is left unattended, or pipes are left uncovered, these shots of arctic air can exacerbate property damage, leading to more claims and larger payouts.

No matter which type of winter weather hazards affect your policyholders, the web-based weather risk tools from Athenium Analytics will help you make the right decisions:

- Atlas, the web-enabled global weather database, helps you make smarter logistical and risk-management decisions using comprehensive historical and forecast data based on proprietary blended models.

- Dexter, the web-based weather forensics dashboard, provides the most comprehensive post-event peril verification, allowing you to map snowfall totals alongside your policies map for a detailed view of high-risk exposures.

- Gauge, the peril risk scoring dashboard, helps underwriters assess natural hazard risks based on decades of historical weather data. See probability data across 11 perils and explore geospatial risk scores to manage your exposures and capacity.

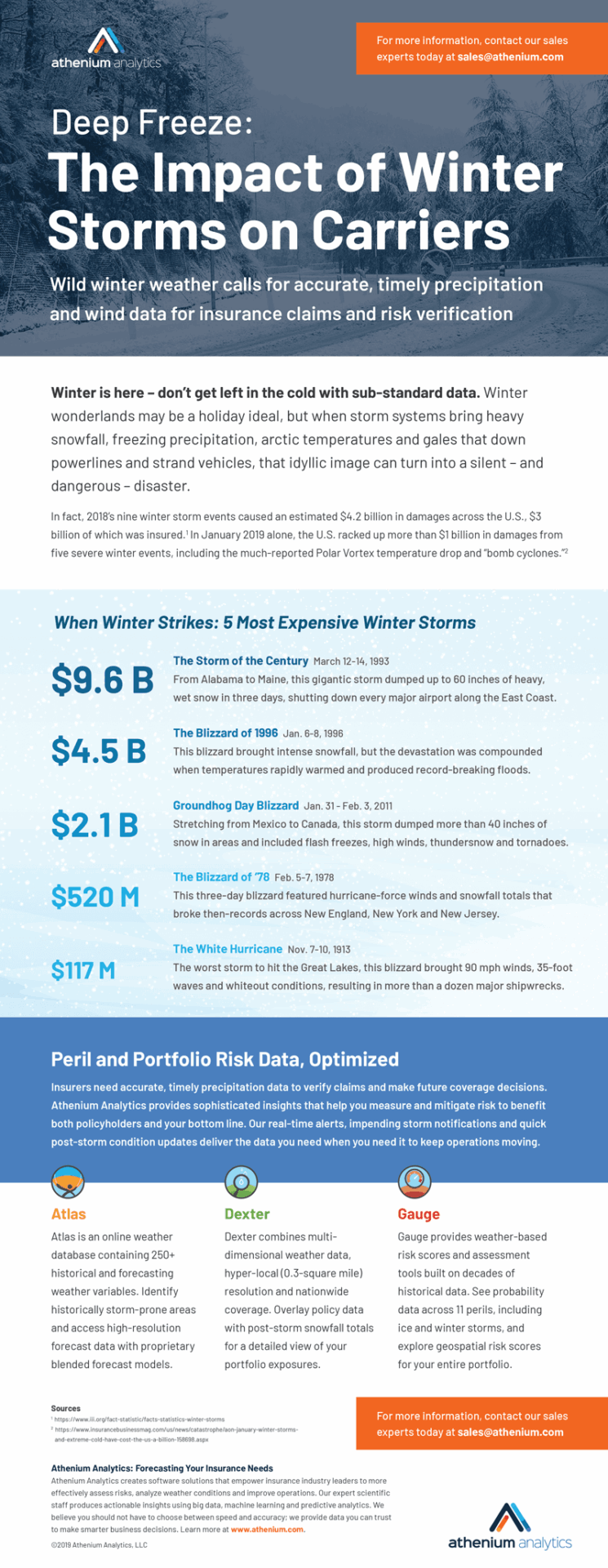

What were the worst winter storms to hit the U.S.? Find out in our infographic “Deep freeze: the impact of winter storms on carriers”: