Dover, NH — April 11, 2022 — Athenium Analytics, a leading provider of enterprise risk analytics for insurance carriers, has announced the release of GaugeQuality, a new Software-as-a-Service (SaaS) solution built to deliver business growth through insight-driven process improvements. GaugeQuality is a new insurance compliance, reporting and workflow-automation suite built on a foundation of 20 years of best practices that Athenium Analytics has established from working with the world’s top insurance carriers.

Athenium Analytics will officially debut the new claims and underwriting audit suite this week at the 2022 RIMS RISKWORLD™ conference, April 10-13, 2022, in San Francisco, California.

Delivering business analytics & audit automation for carriers

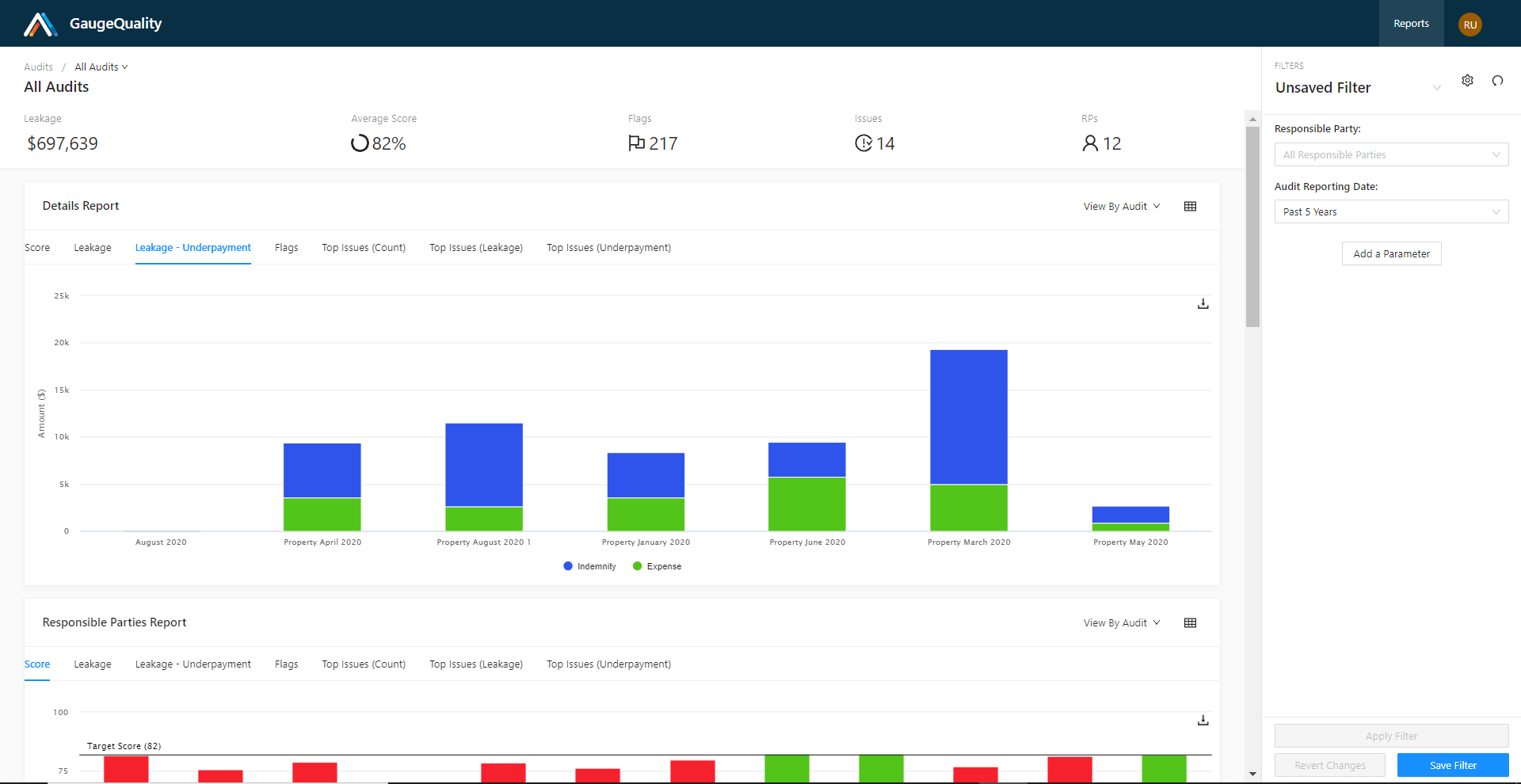

GaugeQuality provides a modern performance-improvement framework—built from the ground up—that helps insurers improve both top-line growth and bottom-line profitability in a highly competitive market. As claims and underwriting workflows become increasingly automated, carriers require more flexible audit and compliance solutions that offer the analysis, training and reporting features needed to uncover actionable business insights at scale. These include helping ensure timeliness of service to policyholders, guarding against excessive payments and fraud and measuring compliance with state regulatory and carriers’ own internal standards.

Jordan Foley, president of Athenium Analytics, commented:

“Every carrier brings a unique approach to examining claims and underwriting performance. That’s why we built GaugeQuality with flexibility in mind, offering the self-administration and extensive configurability that enable QA departments to efficiently tailor workflows and reporting to their business needs.

GaugeQuality’s modern SaaS architecture is designed to be configurable with multiple platforms and helps insurers optimize and automate the various processes essential for identifying key claim and policy financial drivers, uncovering training opportunities and improving overall business performance.”

The GaugeQuality platform includes core modules that are designed to simplify the claims and underwriting audit process from start to finish,” Foley continued. “More importantly, the scalable, cloud-based architecture lays the foundation for next-generation predictive analytics that further enable organizations to optimize team performance and improve financial results.”

Sam Lane, director of operational risk solutions at Athenium Analytics, cited the importance of extensive market research that the company conducted over the past two years into users’ information needs and preferences.

“The resulting insights drove our customer-centric product design and user-friendly feature-function,” Lane said. “The enthusiasm has been building among users of the alpha and beta GaugeQuality versions as we incorporated their feedback into this market-wide solution launch.”

Lane added, “Engineering know-how and insights gained from nearly two decades of leading carriers using another Athenium Analytics product, teamthink, were other essential ingredients guiding GaugeQuality development.”

teamthink, initially released 20 years ago, is today the market-leading solution for insurance carriers seeking quality assurance and has been adopted by nearly one-third of the top-100 property and casualty insurers in the United States. Implemented as installed software, teamthink has robust, unmatched auditing functionality for both claims and underwriting.

“teamthink remains available from Athenium Analytics, with continuous improvements that accelerate later this year, then into 2023 and 2024,” Lane said. Users of teamthink Envoy, a sister product with streamlined functionality, will begin migrating to GaugeQuality this summer.

To learn more about GaugeQuality, visit booth #2104 at the 2022 RIMS RISKWORLD conference, or view additional details and collateral on the Athenium Analytics website.

About Athenium Analytics

Athenium Analytics delivers powerful risk intelligence and SaaS solutions that allow enterprises to measure and mitigate operational risks and risks generated by natural hazards in Earth’s changing climate. Leveraging proprietary data, predictive analytics and machine learning, Athenium helps organizations improve operations and make smarter business decisions. Its solutions are trusted by dozens of the world’s top insurance carriers and more than 60,000 users in more than three dozen nations. Learn more at: https://www.athenium.com.