Wild winter weather calls for accurate, timely precipitation and wind data for claims verification

Winter is here – don’t get left in the cold with sub-standard data. Winter wonderlands may be a holiday ideal, but when storm systems bring heavy snowfall, freezing precipitation, arctic temperatures and gales that down powerlines and strand vehicles, that idyllic image can turn into a silent – and dangerous – disaster.

In fact, 2018’s nine winter storm events caused an estimated $4.2 billion in damages across the U.S., $3 billion of which was insured. In January 2019 alone, the U.S. racked up more than $1 billion in damages from five severe winter events, including the much-reported “Polar Vortex” temperature drop and “bomb cyclones.”

When winter weather strikes, insurers need accurate, timely precipitation data to make coverage decisions and verify claims. Athenium Analytics provides sophisticated insights that help you measure and mitigate risk to benefit both policyholders and your bottom line. Our real-time alerts, impending storm notifications and quick post-storm condition updates deliver the data you need when you need it to keep operations moving.

- Moisture matters: 1 inch of summer rain = 13 inches (avg.) of winter snow

- Catastrophic damages: Winter storms are the third-largest cause of catastrophe losses for insurers, behind hurricanes and tornadoes.

- Climate difference: 57% of U.S. weather stations show a decrease in snowfall totals since 1930; precipitation remains steady because of increased rainfall.

- Blue-sky blizzards: After a severe snowstorm, blizzard-like conditions can occur even with clear skies if winds are strong enough (in excess of 35 mph) to pick up snowdrifts and decrease visibility.

Peril & portfolio risk data, optimized

Severe winter storms, perhaps more than any other type of severe weather, spotlight the need for accurate forecast data and post-event analysis. Insurers must manage risk in storm-prone areas and verify claims faster to ensure customer satisfaction and claim quality. Athenium Analytics offers a suite of risk analysis and data solutions to help insurers understand a storm’s impact and quickly quantify claims and payout information to keep business goals on track.

Atlas

This web-enabled, global climate and meteorological database tool contains 250+ historical and forecast weather variables to help you make smarter logistical and risk-management decisions. Identify historically storm-prone areas and access high-resolution forecast data with our proprietary blended forecast models.

Dexter

This web-based weather forensics dashboard combines multi-dimensional weather data, hyper-local (0.3-square mile) resolution and nationwide coverage, plus the most comprehensive peril verification software available today. Overlay policy data with post-storm snowfall totals for a detailed view of your portfolio exposures.

Gauge

This cloud-based risk management dashboard for insurance underwriting provides weather-based risk scores and assessment tools built on decades of historical data. See probability data across 11 perils, including ice and winter storms, and explore geospatial risk scores for your entire portfolio to monitor capacity and manage exposures.

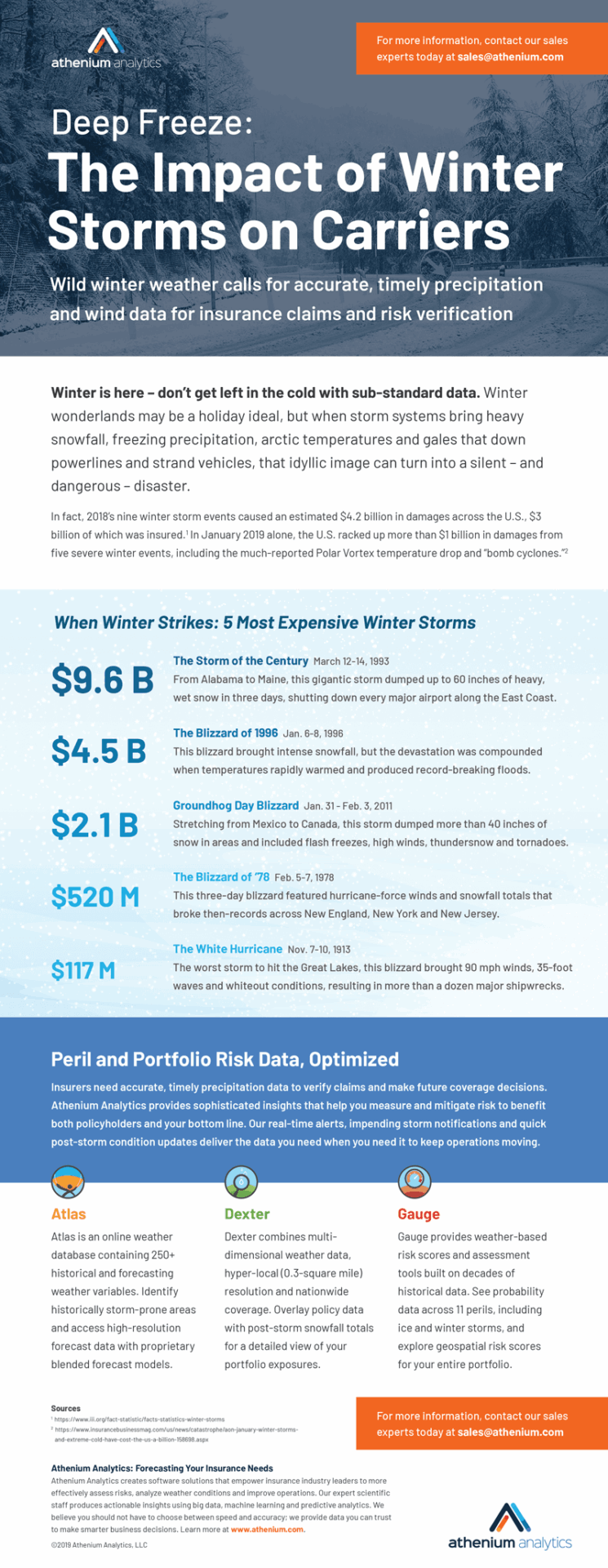

See the top 5 most expensive winter storms in our new infographic “Deep Freeze: The Impact of Winter Storms on Carriers”: