In October 2020, Athenium Analytics announced a strategic collaboration with Aon to jointly develop a new open claims audit and alerting platform called Claims Signal. Since that time, our teams have been hard at work building out new functionality and alerts to help our insurance clients optimize claims quality and enhance adjuster performance. Earlier this month, we quietly released the most significant update to Claims Signal since the platform launched last year: adding two new predictive models that deliver powerful insights across all auto-related open claims. This includes an attorney involvement model and a subrogation likelihood model, both of which are now available to Claims Signal users.

Predicting the risk of attorney involvement

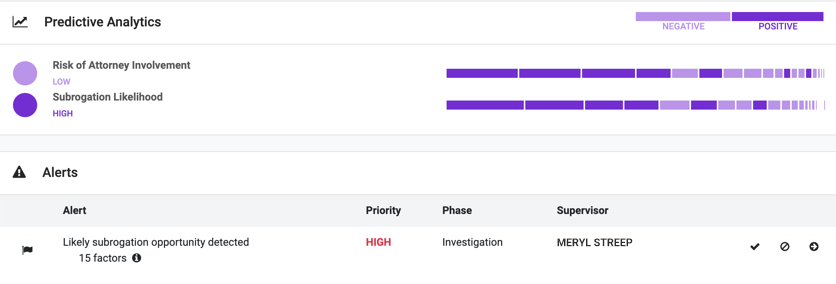

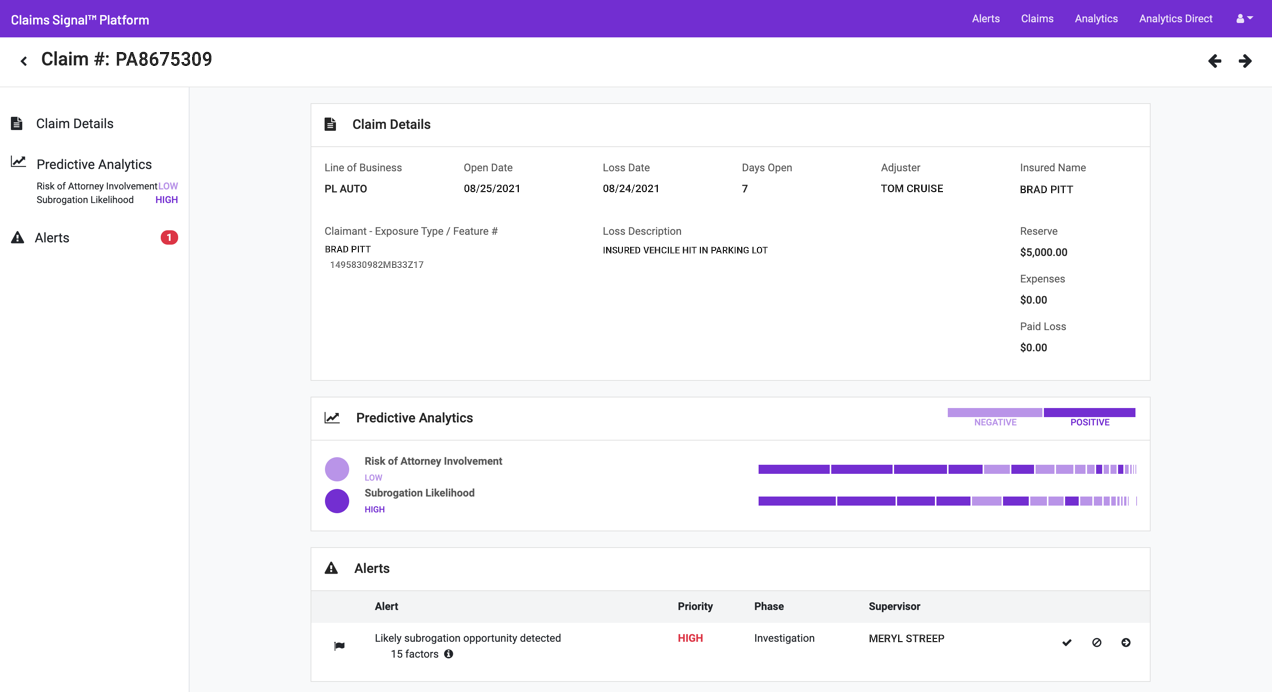

Claims Signal’s new attorney involvement model analyzes historical loss run data as well as injury details, accident information and correspondences with involved parties to determine the overall probability for attorney involvement on any open auto claims. In addition to automatically extracting insights from both structured and unstructured claims data, the model leverages numerous action detectors to provide daily updates to the probability of attorney involvement for each auto claim. The model incorporates both positive and negative risk factors and then provides a clear low/medium/high status based on the latest data.

Assessing subrogation likelihood

Similar to the attorney involvement model, the subrogation likelihood model leverages both historical and active claims to predict the probability of a subrogation recovery opportunity across each open auto claim. The model uses NLP analysis to extract key file details related to driver actions/potential liability and references them against loss-state regulations to predict the subrogation potential beginning on day one. The model then incorporates new factors throughout the claim lifecycle, providing daily status updates as key details change. These insights allow adjusters to focus their investigations and understand how financial liabilities may shift as the claim moves from FNOL to close.

What it means for insurance carriers

These two new predictive models build on Claims Signal’s core mission of helping insurers drive claims quality and improve financial performance. The platform’s predictive scoring and open-claim alerts allow claims teams to increase productivity and improve outcomes by leveraging the power of big data.

Claims Signal’s NLP engine monitors 100% of open claims and automatically detects potential handling issues so they can be addressed before a claim is closed. The software analyzes quality across 7 phases of the claim lifecycle and 30+ dimensions, helping carriers increase productivity, reduce leakage and deliver better outcomes for policyholders.

These new attorney involvement and subrogation models enable insurers to leverage the power of predictive analytics for open claims and drive claims outcomes proactively instead of reactively. Discover how Claims Signal can optimize your claims workflow while delivering an estimated 4-6% improvement in claims indemnity and expenses.