What does calibration really mean and how does it fit into the modern claims and underwriting audit process? In the most literal sense, calibration is the comparison of a measurement value against a known reference or standard. For instance, you might calibrate your watch by using an atomic clock or calibrate a compass by facing true north.

In the insurance compliance world, the calibration process involves multiple people auditing a file (or set of files) and comparing the results. Calibration helps ensure that each reviewer is evaluating performance based on the same set of standards and best practices. Essentially, calibration allows insurance leaders to “audit the auditors,” which helps increase review consistency, remove bias and promote objectivity in an often a subjective process.

Insurance carriers can learn a tremendous amount about their claims and underwriting performance by implementing a calibration process into their quality program.

Two types of insurance audit calibration

There are two key types of calibration that claims and underwriting audit teams typically perform: ongoing calibration and group calibration. These calibration approaches are different and will ideally be used together in more mature quality programs. But if you’re just getting started (or looking to revamp your existing program), make sure you understand the differences to ensure you’re properly utilizing the calibration process to achieve your goals.

1. Ongoing calibration

Ongoing calibration is a “review of a review” – or auditing the results of a previous file audit. The first review is typically called a primary review, while the follow-up review is called a secondary review.

Ongoing calibration is a “review of a review” – or auditing the results of a previous file audit. The first review is typically called a primary review, while the follow-up review is called a secondary review.

Primary reviews can be performed by peers, QA specialists or direct managers where applicable. Secondary reviews are generally performed by a QA specialist or a mid-senior level field manager. The ongoing calibration process is typically performed on a monthly or quarterly basis and is best used for training and performance improvement purposes.

Sometimes insurance carriers will leverage ongoing calibration to inform and evaluate individual contributor KPIs. We urge carriers to tread carefully with this approach because calibrations at the IC-level can feel punitive and, more importantly, may not be representative of an employee’s actual performance. That’s because most insurers aren’t equipped to complete enough secondary reviews to produce statistically valid results at the individual contributor level, which can yield inaccurate or misleading data.

On the other hand, ongoing calibration can deliver extremely valuable insights for employee training and measuring the adoption of new initiatives. It can also be a very effective performance management tool because ongoing calibration provides valuable data and documentation on how recent feedback and coaching initiatives are impacting performance.

2. Group calibration

The second type of calibration found in the claims and underwriting compliance process is called group calibration. Group calibration, also referred to as master file calibration, yields very different insights than ongoing calibration. In the group calibration process, one or more files are selected for review by a group and each person’s responses are compared to a single “master file” that contains the optimal responses. The master file functions like an exam answer key, allowing carriers to evaluate reviewers against industry guidelines and internal best practices.

The group calibration exercise starts with a subject-matter expert reviewing a source file (e.g., a complex BI claim) and providing the “correct” responses based on all available information. Then each member of the group reviews the same source file so their responses can be compared to those from the master file. And with a modern audit & compliance like GaugeQuality, you can easily run calibration reports that automatically identify any responses that don’t align with the master file.

The great thing about group calibration is that it doesn’t take very many files to identify skill gaps across the claims and underwriting process. Group calibrations are also more collaborative than secondary reviews and allow leaders to celebrate strengths in addition to addressing improvement opportunities. This not only increases buy-in among team members, but also encourages them to take a more active role in QA initiatives by working together to address performance gaps across the department.

Group calibration creates an environment where development planning and goal setting are based on business results rather than individual results, making it easier for everyone to understand and achieve critical KPIs.

Choosing the right calibration for your insurance team

So, which type of calibration is right for your organization? The answer is probably a little of both. Athenium Analytics has been working with insurance carriers for 20 years to help them build best-in-class claims and underwriting audit programs. Most of the QA teams we see utilize an ongoing calibration approach, but far fewer insurers leverage group calibration as part of their continuous improvement plans. When considering calibration for your own program, some questions you may want to ask include:

- What does your organization want to do with calibration results?

- How much time can your organization devote to calibration?

- Who is responsible for determining what calibration means in your organization?

- How important is buy-in to calibration results to the success of your quality program?

- Are quality results more important for IC feedback or are they used for driving and improving overall business results, or is it really both?

Calibration is an essential part of any best-in-class quality program. It increases buy-in for QA initiatives and can help increase employee engagement. It’s a fantastic way to identify continuous improvement opportunities, facilitate employee training and even inform company-wide KPIs. But calibration cannot just happen once; it must be an ongoing process where the results (and progress) are shared at every level of the organization.

Build a best-in-class audit program with GaugeQuality

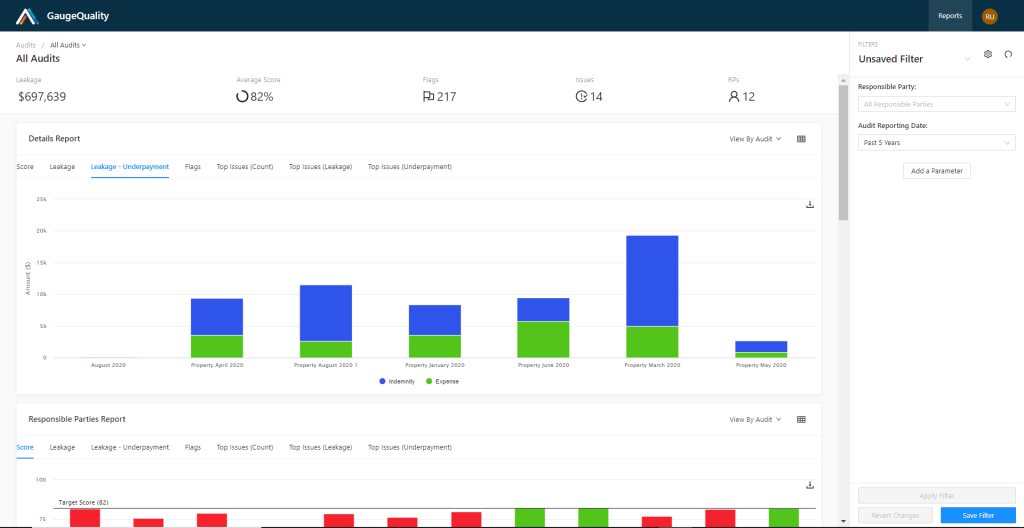

GaugeQuality is a new insurance audit, compliance and workflow-automation suite built on a foundation of 20 years of industry best practices established from working with the world’s top insurance carriers. The software provides a modern performance improvement framework—built from the ground up—that helps insurers improve topline growth and the bottom line in a competitive market.

With GaugeQuality’s advanced analytics, claims and underwriting teams can uncover deeper business insights to drive continuous improvement and reduce leakage. Discover how GaugeQuality can help you supercharge your audit and compliance program by delivering powerful features like calibration reports, questionnaire builders, interactive dashboards and flexible reporting powered by Tableau.

Learn more about the GaugeQuality insurance audit suite now »

About the Author

Julie Markert is a Senior Customer Success Manager at Athenium Analytics and has been working in the insurance industry for over 17 years. Before joining the company, she spent 13 years at Liberty Mutual where she worked in nearly every area within personal lines insurance, including distribution analytics, product/state management, claims quality and strategy. Julie has 8-years of experience focused on QA strategy, design, and questionnaire development between her time at Liberty Mutual and Athenium. Julie has a B.S. in Economics and Certificates in International Business and Qualitative Analysis from Arizona State University.