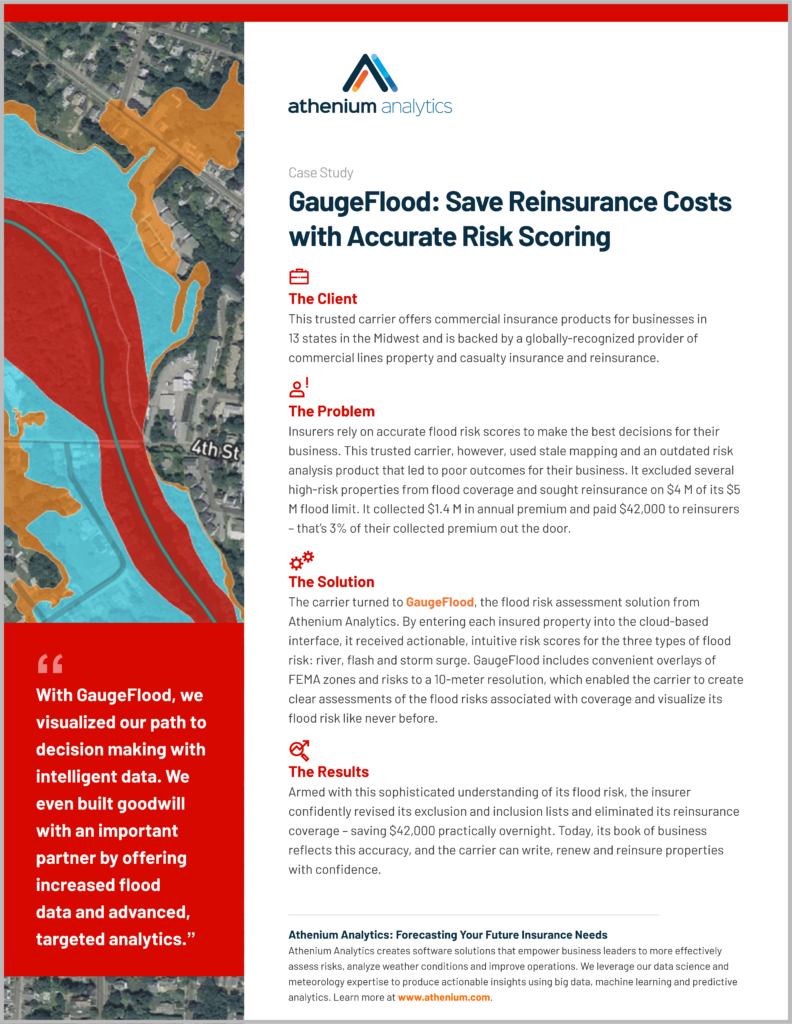

Understand flood types and their effect on your company’s flood risk coverage

Our flood risk scoring solution manages three types of flood perils for insurers, calculating risk scores to help you best understand the probabilities associated with insuring properties against flood risk.

… But what does this mean, exactly? What are the three types of floods and how do they differ?

Below, we examine the different GaugeFlood modules and how they can assist your underwriters and claims handlers.

When used together, GaugeFlood’s River, Flash and Storm Surge modules give your insurance company a holistic view of flood risk to ensure you’re prepared for all the flood claims – not just some of them. Enhance your flood risk scoring with accurate modeling and flood data to keep your book above water.

River floods

River flooding occurs when large volumes of upstream water surge into water channels, overwhelming their natural pathways and causing them to overtop their banks. The additional fluvial flow impacts the communities established on or near these surrounding floodplains.

River flooding occurs when large volumes of upstream water surge into water channels, overwhelming their natural pathways and causing them to overtop their banks. The additional fluvial flow impacts the communities established on or near these surrounding floodplains.

The phenomenon of river flooding is not new — in fact, many early civilizations’ origin stories include massive flood events that reshaped environments and cultural beliefs. However, modern conditions are contributing to the increasing prevalence of river floods:

- Nearly 41 million Americans and assets totaling more than $5.5 trillion are at risk from river and other waterway flooding in the contiguous U.S. every year.

- U.S. inland floodplains may expand by 45% by 2100, putting even more people, places and things at risk.

- Climate change amplifies river flooding by influencing variables that cause floods, like rainfall and snowmelt.

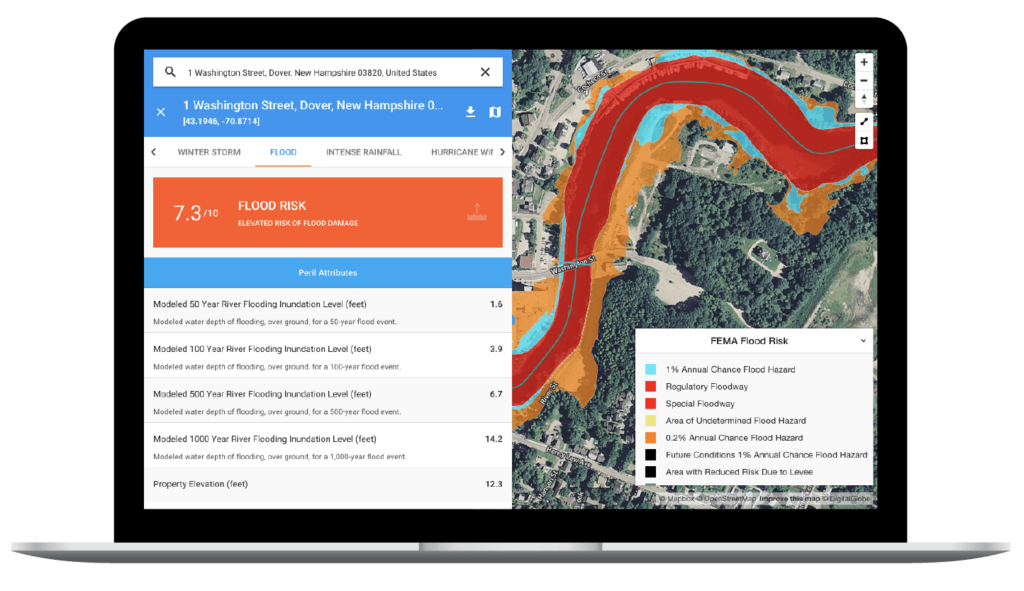

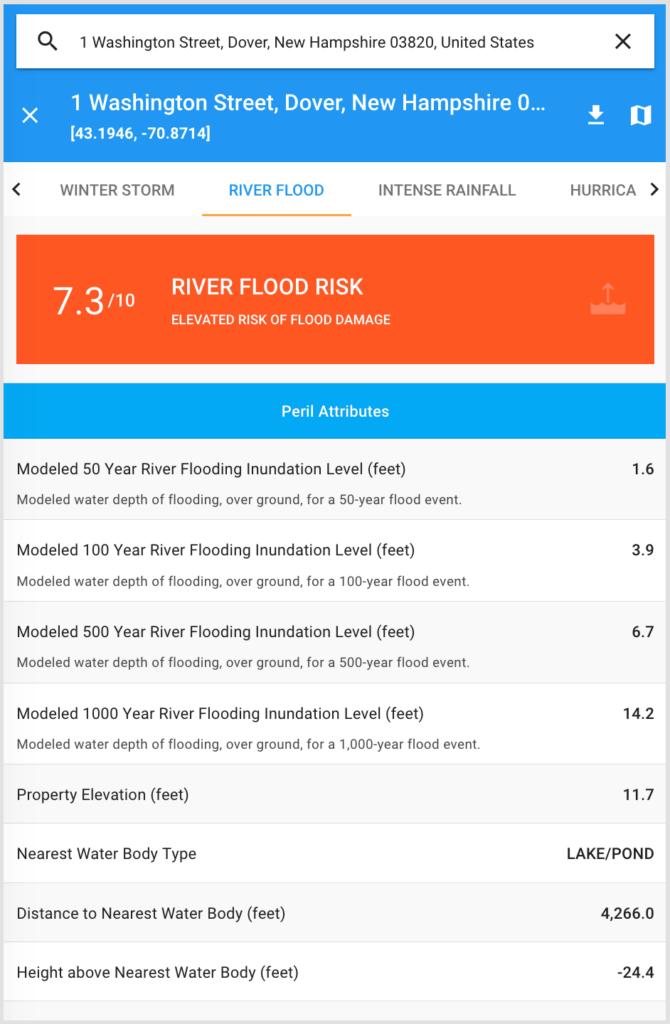

For insurers, agriculturists, and others dependent on weather and flood data, GaugeFlood risk scores can help identify where you need to prepare for river flood events given elevation, distance to water and modeled inundation depth for 50-yr, 100-yr, 500-yr and 1,000-yr flood events.

Flash floods

Flash flooding is the umbrella term for what occurs when large amounts of water quickly flow through areas of low land. Typically, flash flooding happens so quickly that advanced warning is not possible, making flash flooding the most hazardous weather peril in the U.S. And modern conditions are doing nothing to curb their frequency:

- Land development and urban sprawl are increasing the number of impervious surfaces (like concrete) that cannot soak up heavy rainfall. This boosts runoff up to 6x more than on natural terrain.

- Warmer temperatures have increased the amount of water storms can hold; this means more significant rain events and more flash flooding. From 1958-2012, rainfall totals have jumped 71% in the Northeast, 37% in the Midwest and 27% in the South.

- It only takes 6 inches of flash flood water to knock a grown adult off their feet and only 2 feet to float a car.

Insurers across the U.S. need flash flood risk scores to protect their portfolios and loss ratios from severe flash flood events. This unpredictable peril can cause devastation, but with GaugeFlood risk scores, you can prepare for the worst using probabilistic scoring based on soil hydrologic attributes, land use and land cover types, rainfall intensity and topography.

Storm surge

This GaugeFlood module is based on hurricane storm surge, which is a complex weather phenomenon that occurs when a powerful tropical or posttropical storm generates intense wave activity and sucks a dome of water into its low-pressure center. When combined, the waves and water dome pound the shoreline creating areas of severe coastal flooding and large-scale damage.

The cause of increased storm surge impacts is two-fold: Storm intensity and frequency are rising, as is the population of hurricane-affected regions. Consider these modern-day conditions:

- In the Gulf Coast region (often the target of storm surge activity), 72% of ports, 27% of major roads and 9% of rail lines sit at or below an elevation of only 4 feet.

- More than 670 U.S. communities will face repeated flooding by the end of this century; it’s happening in more than 90 coastal communities already.

- Water weighs approximately 1,700 pounds per cubic yard. Storm surge waves pounding these densely populated coastlines causes property damage to skyrocket.

Hurricane storm surges cannot be avoided, but they can be predicted. Carriers use GaugeFlood’s probabilistic modeling and risk scoring to analyze storm surge potential by factoring in distance to coastline, elevation and hurricane frequency scores. With GaugeFlood’s accurate risk maps and granularity down to the individual property level, insurers have the most reliable data to make decisions based on the risk factors associated with the storm surge damage.

Learn more about our flood risk scoring software for insurance carriers.

See how our insurance customers use GaugeFlood

See GaugeFlood in action: Contact our flood experts today to schedule your free demo!