Property risk analytics

Assess property hazards, replacement costs & portfolio risk in a single, detailed report.

Leverage proprietary risk modeling, aerial imagery analytics and reliable structural data to generate actionable risk intelligence to measure the climate resiliency of your business using the property risk report damageability insights.

Assess structural & natural hazard risks across your portfolio

The property risk analytics solution from Athenium Analytics delivers deep, actionable intelligence on both structural and natural hazard risks for any U.S. property.

This unique offering combines computer vision technology and powerful risk analytics trusted by top global insurance carriers, with detailed intelligence distilled into a single report.

By packaging key insights from both technologies, this data-driven solution offers robust property intelligence reports that enable you to analyze, quantify and mitigate risk across your entire portfolio in a changing climate.

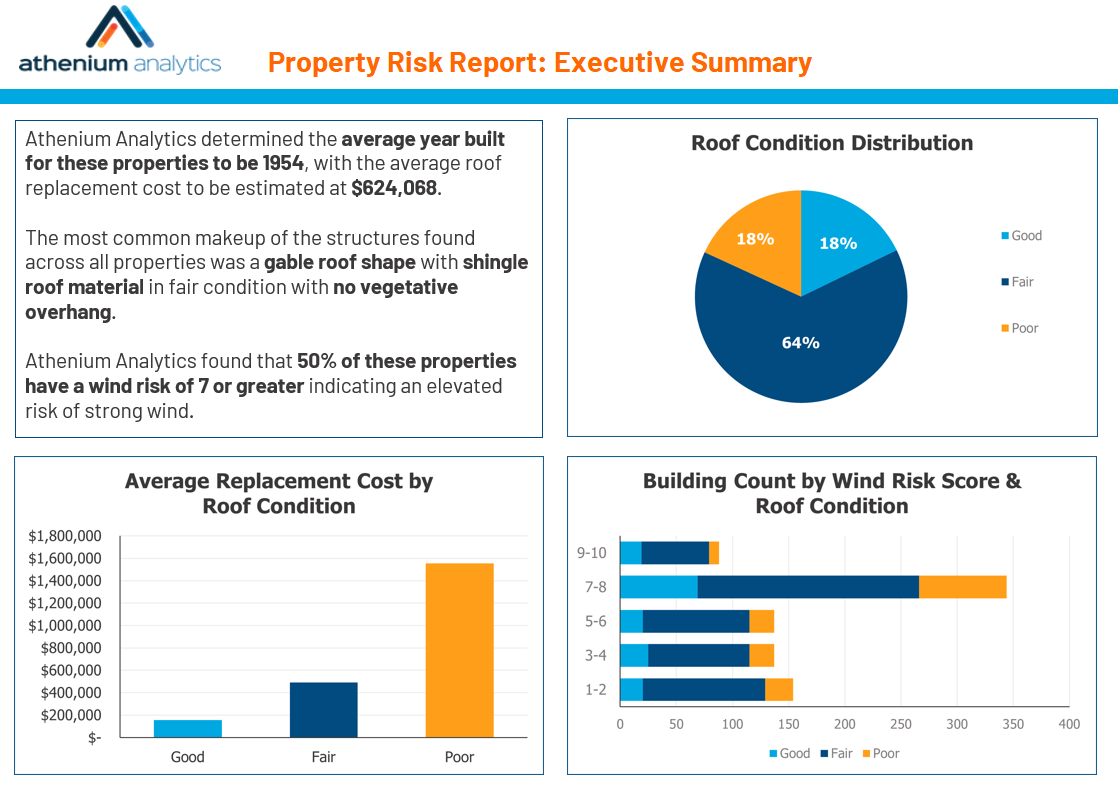

Snippets from a sample property risk report

🗎 Sales sheet (pdf): Insurance property analytics

🗎 Sales sheet (pdf): Real estate property analytics

Submit your portfolio, get risk intelligence for each address

Learn how the property risk analytics bundle delivers actionable property risk insights across your portfolio.

Analyze your entire portfolio nationwide

With complete coverage across the contiguous U.S. (CONUS), the property risk analytics bundle allows you to understand exposures across your entire commercial or residential portfolio.

Quantify replacement costs using local data

Our proprietary damageability model incorporates building size, materials, location and other factors to provide a reliable dollar value to help you understand true replacement costs.

Assess the true threat of storms & perils

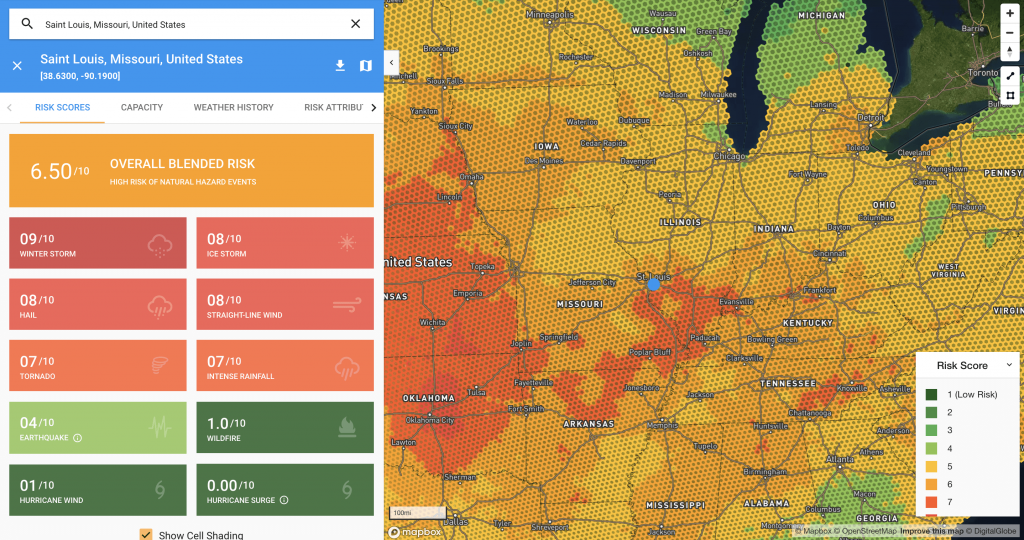

Our natural hazard risk scores analyze the frequency & severity of 11 separate perils and quantify property risk with clear, 1-10 scores. This same technology is trusted by some of the nation’s top insurers.

Write new business & inform policy renewals

Armed with actionable risk intelligence for each address, your team of underwriters or investors can make smart, data-driven decisions about new & existing properties to protect your bottom line.

Model local/regional risk appetite & capacity

This address-level data helps you assess portfolio risk on a macro level. Understand how local property exposures and liabilities fit into your wider portfolio and adjust based on risk appetite.

Generate accurate pricing & rating data

Understanding the property risk variables & scores in your report

Structural risk attributes

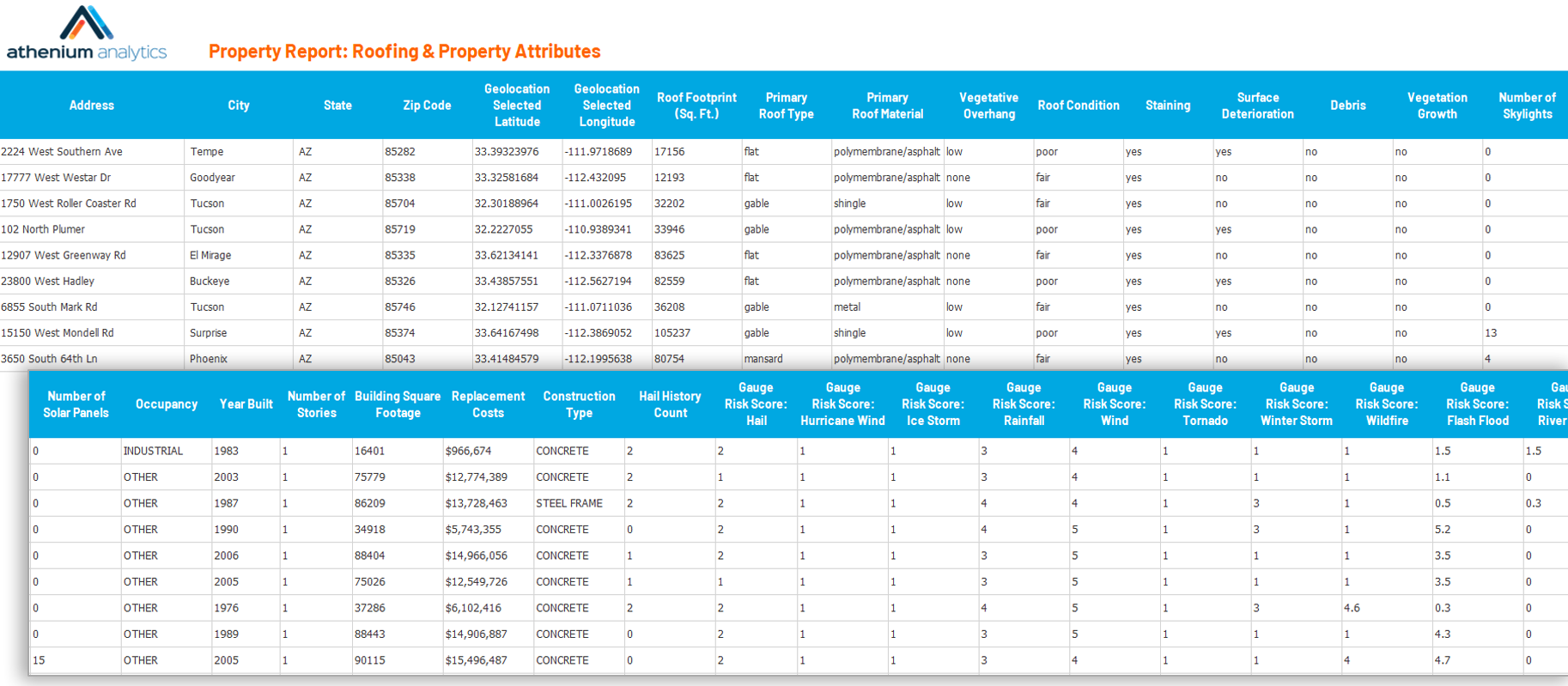

The standard property risk report includes the following variables, which are derived from a combination of aerial imagery analytics, proprietary risk modeling and local property data. This same technology was recently used to assess more than 80,000 structures for the U.S. military:

- Replacement costs

- Year built

- Number of stories

- Building square footage

- Construction type

- Occupancy

- Roof footprint

- Roof condition (including sub-data)

- Roof type & material

- Solar panels

- Skylights

- Vegetative overhang

- In-ground or above-ground pool

- Trampoline

Natural hazard risk scores

The property risk report delivers 1-10 natural hazard risk scores for each address, built on decades of historical data. Visit the Gauge risk scoring page to learn more about the details. Reports contain individual scores for 11 perils, including:

- Hail

- Straight-line wind

- Tornado

- Ice storm

- Winter storm

- Intense rainfall

- River flood

- Flash flood

- Hurricane wind

- Hurricane surge

- Wildfire

- Earthquake (for 9 states along the New Madrid fault line)

Delivering your property risk report

This service leverages proprietary risk modeling and aerial imagery analytics that is cross-checked with reliable property & structural data to generate clear and actionable risk intelligence. Our computer vision algorithms analyze each address and generate a full list of risk attributes to help you assess exposures across your portfolio.

Simply send us your book business and you’ll receive back a detailed list of risk scores and attributes for each address. The reports are delivered in a flat-file spreadsheet, allowing you to easily scan, sort or export your risk data for further review. API delivery may be possible for high-volume clients.

Property API: Assess risk with 60+ variables across 150M+ addresses

- Nationwide database of commercial & residential properties across the contiguous U.S. (CONUS), searchable by address, with support for both single & bulk location requests

- Proprietary property & roof replacement cost models for both commercial and residential properties

- Subclass replacement costs for garages, roofs & windows

- Regional modifiers to account for changes in labor costs

- New! Replacement cost models reflect 2022 inflation

- Detailed building & structural attributes for single- and multi-structure properties, including:

- Gross & living area square footage

- Roof square footage, construction & materials

- Number of stories (and more)

- Granular geospatial & parcel insights, including full address, geocode, latitude/longitude, zoning info and distance to the nearest fire station, among others

- Property ownership & tax data, including assessed values, total market value, recent transactions, properties per parcel and owner details

Need a better way to analyze property risk across your portfolio?

Amid rising real estate prices and record-low inventory, investors continue to snap up commercial and residential properties. Meanwhile, insurers are wrestling with the rising costs of severe weather threatening properties nationwide.

Roofs are a big factor in the inspection and underwriting process, but data like square footage, year built, replacement costs, swimming pools and local weather risk all influence premiums and purchase decisions. However, this data can be difficult to find and track over time without a dedicated property risk reporting solution. Discover all the property risk factors you need to consider, and how Athenium Analytics can help you analyze all these risks in a single report.

On-demand webinar: Enhance your property-risk reports

Insurers and property investors often struggle to find reliable data for new and existing properties. As many learn the hard way, assessing true property risk requires more than just self-reported data from owners and agents. Many users rely on free mapping tools, use cheap data aggregators or buy multiple reports for a single property.

With rising property values and severe weather risks, it’s more important than ever for investors and underwriters to understand the property risks across their portfolios. Learn how this new technology can help.

Learn more about the technology behind the reports

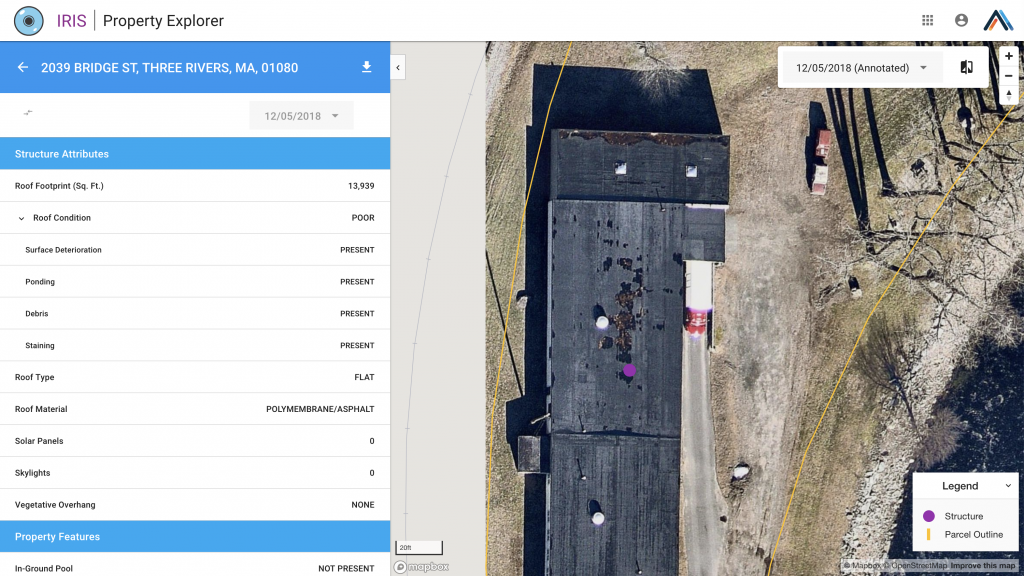

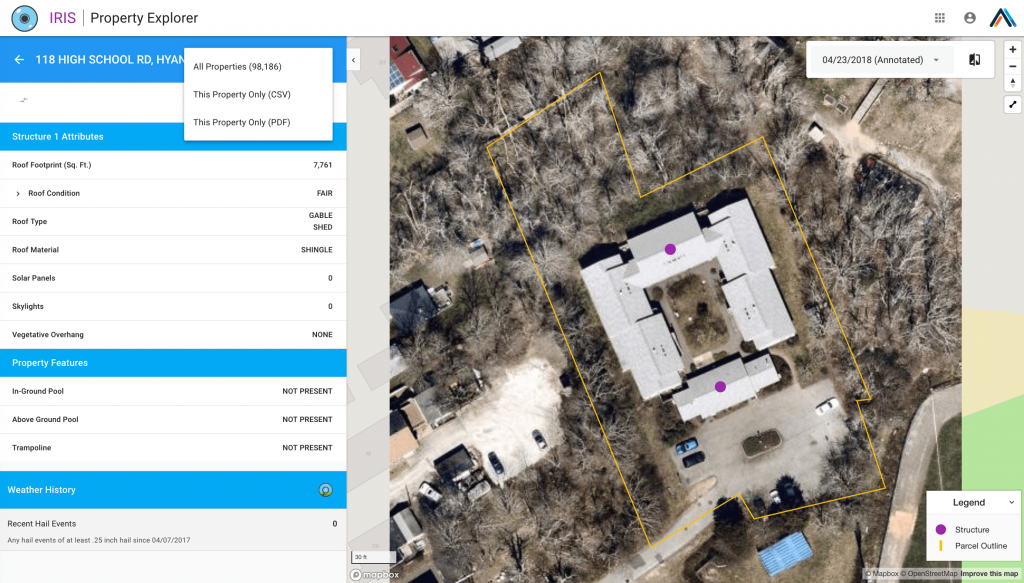

IRIS – AI-enabled imagery analytics

Much of the the property and structural insights available in this risk report are delivered by the IRIS aerial imagery analytics platform. IRIS uses aerial imagery and proprietary computer vision technology to identify key property risk attributes without an on-site inspection.

Gauge – Natural hazard risk scoring

Product support

Call (888) 320-7693 or email us at support@athenium.com

Let’s get started

Request a sample file, get custom pricing, or speak with a member of our team.