Claims & underwriting APIs

On-demand weather intelligence & risk scoring for P&C insurance carriers.

All the analytics & insights insurance teams need to manage, mitigate & respond to natural hazard risks – delivered over API.

Arm your teams with actionable, insurance-focused weather risk intelligence

Weather risk data solutions from Athenium Analytics provide the on-demand data your teams need to make faster, smarter decisions across claims & underwriting. Improve risk selection, reduce loss adjustment expenses, identify potential fraud and settle claims faster with peril-driven risk analytics. These curated claims and underwriting bundles offer key benefits over traditional insurtech tools, including:

- On-demand access to key insights across your existing workflow

- Native integration with your claims, policy, client & exposure data

- Integration with leading third-party PAS & CMS platforms

- Easy implementation with limited IT involvement

With convenient API access to our proprietary weather intelligence data, your teams can pull actionable, insurance-focused insights when and where you need them.

Claims API

The claims data solution from Athenium Analytics bundles all the data and insights you need to verify, triage & settle natural hazard claims quickly and consistently across your team.

View claims bundle

Underwriting API

The underwriting data solution from Athenium Analytics bundles all the data and insights you need to optimize risk selection, score natural hazard risk and write better business

View underwriting bundle

Enterprise API

Looking to build a custom data solution tailored for your unique business needs? Learn more about our full suite of weather, property and business insights available on demand.

Request more information

Proprietary weather intelligence built on trillions of data points

distinct weather data sources, including weather stations, satellites, radars, buoys, aircraft and more.

historical and forecast weather variables available for insurance-driven weather and climate risk analytics.

years of historical weather data that is cleansed, crunched & quality-checked to provide superior insights.

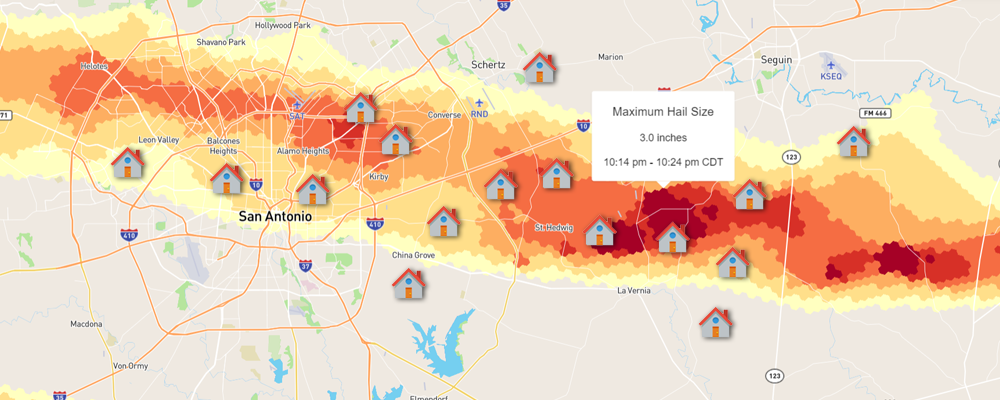

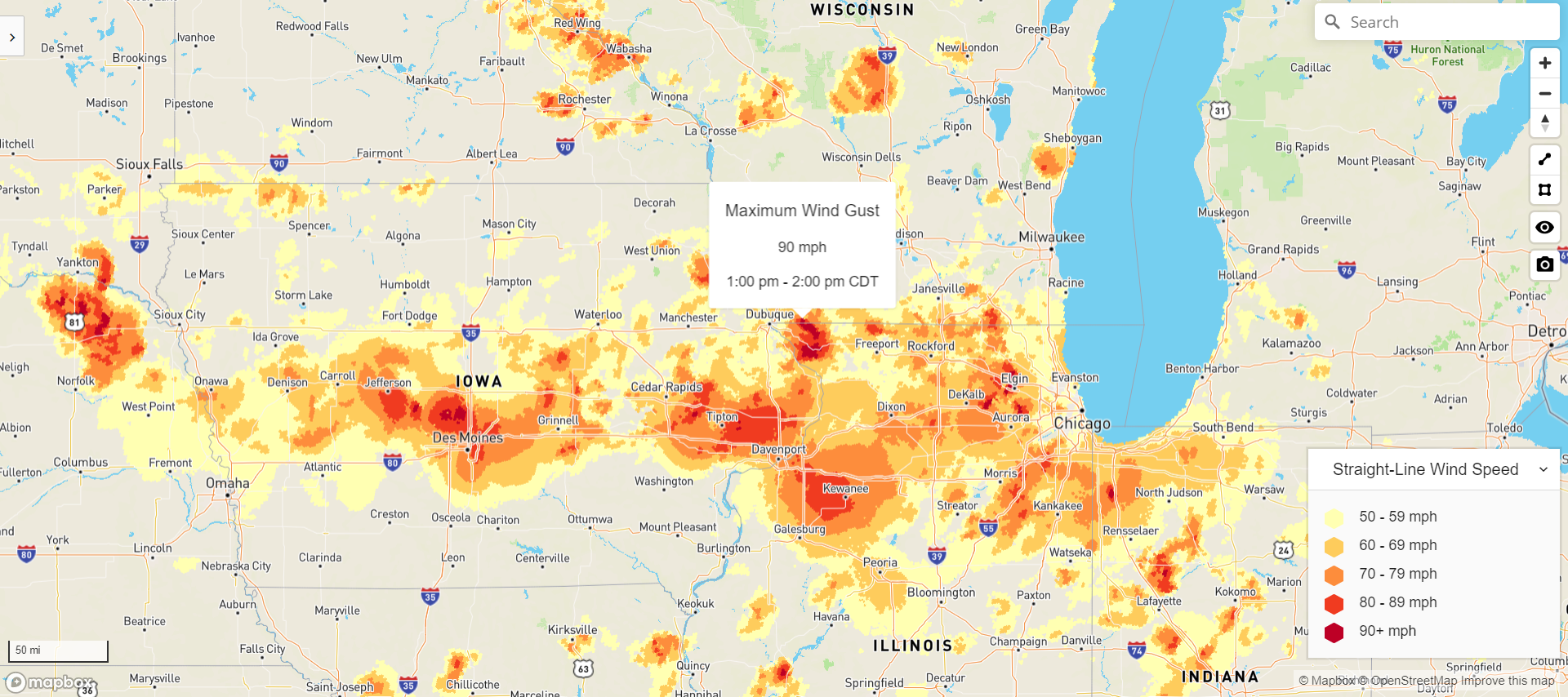

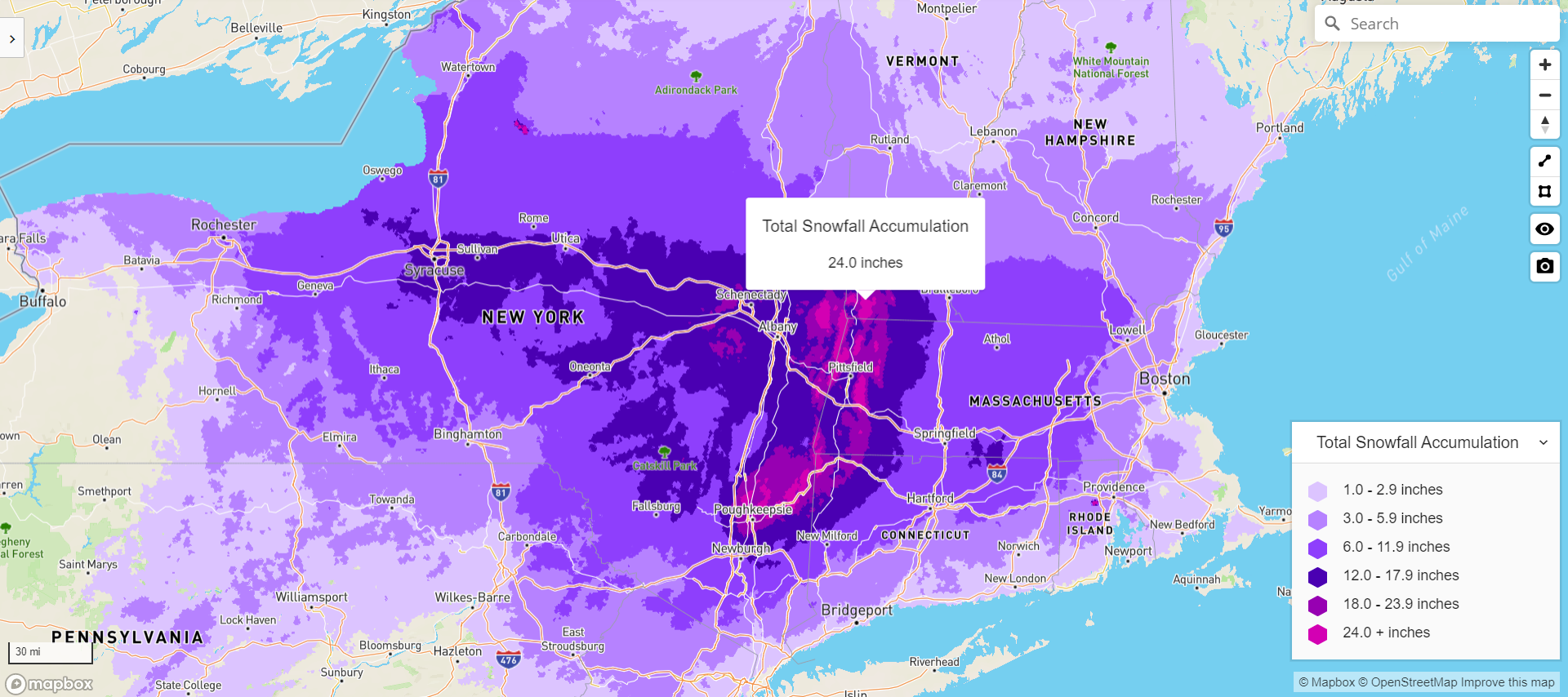

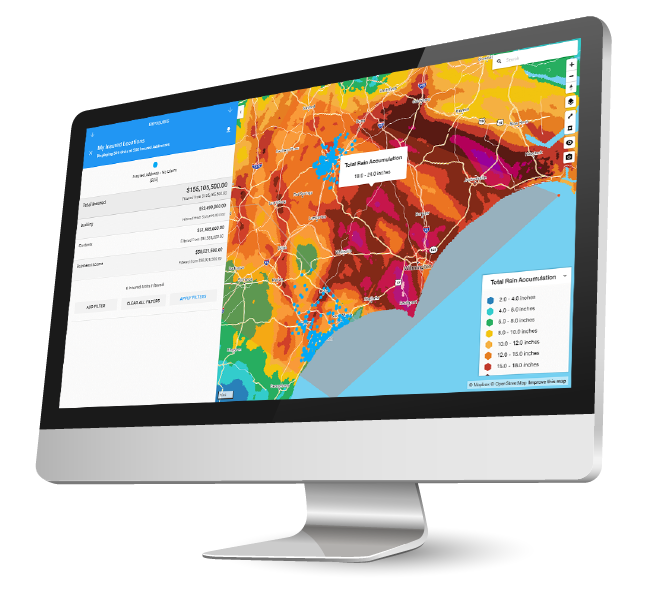

Weather forensics data for claims

Verify, triage and settle claims quickly and consistently with on-demand weather intelligence for P&C claims delivered over API.

Verify claims & identify fraud

- Access high-resolution storm data across 8 perils, including hail, wind & precipitation

- Pull hyperlocal storm footprints to assess exposures from your book of business

- Expedite low-risk claims & identify potential fraud using weather analytics data

Triage claims efficiently

- Pull storm severity reports with granular, hourly data for each peril

- Use post-storm forensics to efficiently deploy resources

- Integrate policy data with geospatial insights to find hardest hit clients

Settle claims quickly

- Use hyperlocal storm data to quickly settle low-risk claims

- Use hyperlocal hazard analytics to contact hardest hit clients before the FNOL

- Pull instant insights within your claims management system (CMS)

Use case: triaging hail claims

- Which insureds were hit by the latest hail storm in Texas?

- Which properties saw 3″ hailstones vs. minor 0.25″ hail?

- Which high-value clients require proactive outreach before a FNOL?

- Which claims occurred inside or outside the storm footprint?

- Which claims can be paid and which have hallmark signs of fraud?

Core components

- Hyperlocal weather verification by location and peril

- Perils include: hail, wind, rain, snow, sleet & tornadic storm

- High-resolution storm data available within 90 minutes

- Hour-by-hour weather data at 1km resolution

- Geospatial storm contours by peril & date (geojson or kml)

- SPC wind, hail & tornado observational data

- Hail & wind history reports by location

- 7-day forecast data

Visualize weather forensics data in your preferred mapping tool

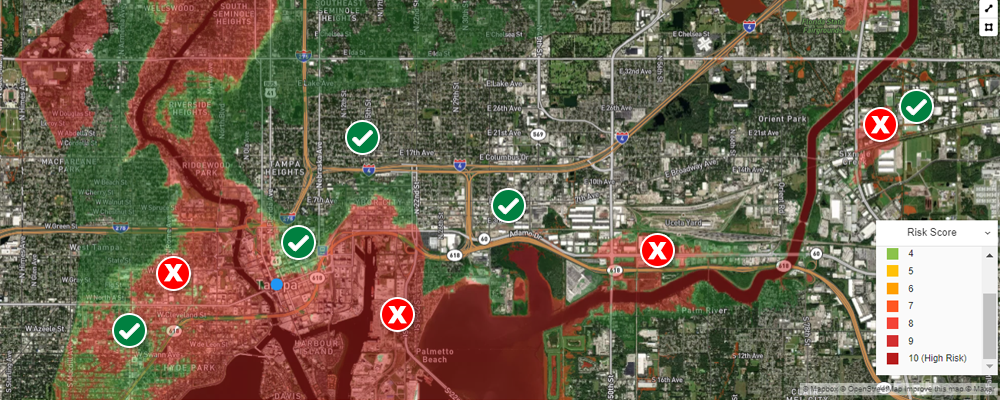

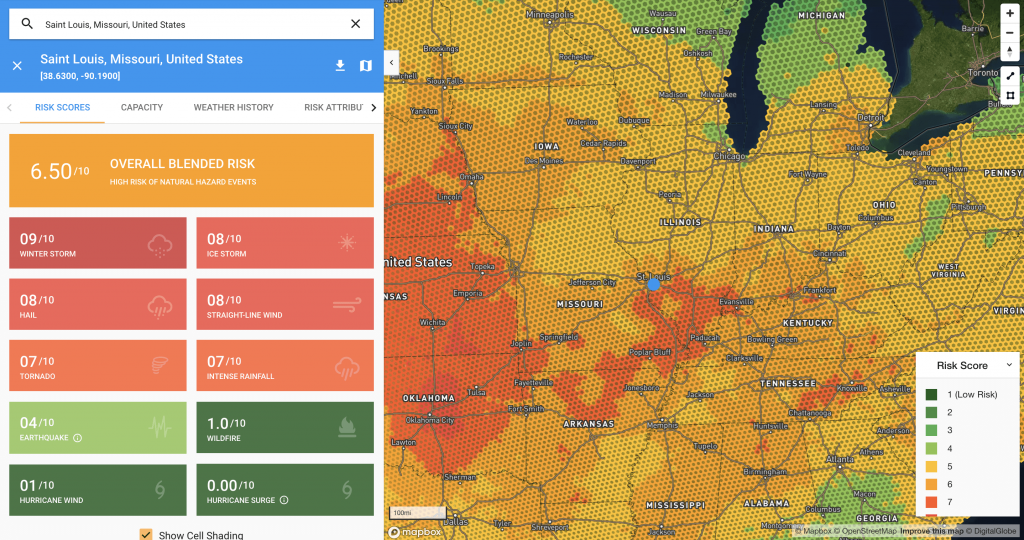

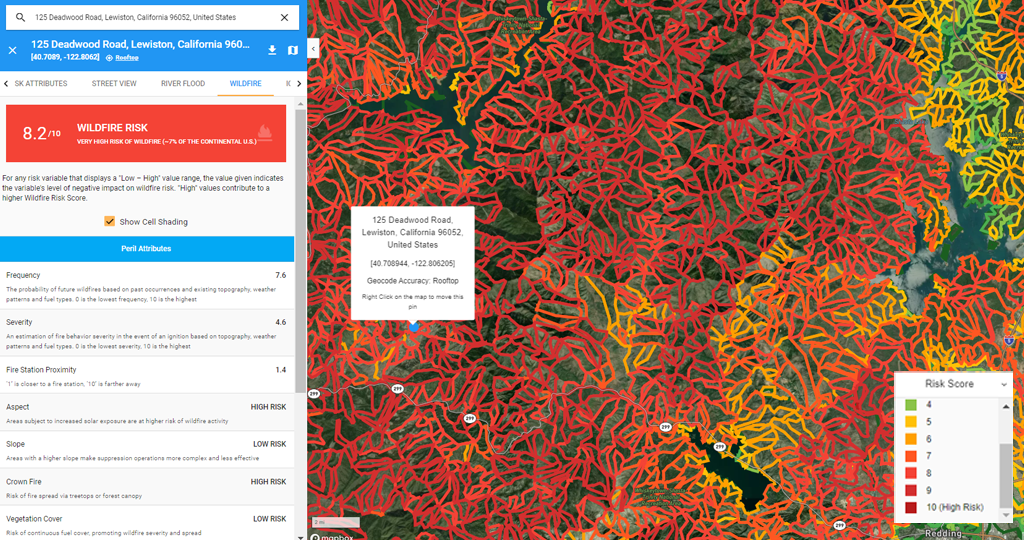

Hazard risk analytics data for underwriting

Optimize risk selection and write better business with on-demand hazard risk scoring & analytics delivered over API.

Optimize risk selection

- Assess property risk with separate & blended risk scores across 11 hazards

- Understand local hazard risks and trends across various regions

- Reduce overall policy risk to improve ratios & drive profitability

Grow your book of business

- Write business in new areas using powerful insights down to the neighborhood

- Find new business opportunities in existing areas previously considered high risk

- Understand peril history/trends at each address to inform pricing & renewals

Reduce workflow risk

- Provide a single, on-demand risk intelligence engine to your entire underwriting team

- Write business in every state with nationwide (CONUS) data coverage

- Access actionable intelligence built on decades of historical data

Use case: writing new business in Florida

- Which regions are at risk for catastrophic flooding or hurricanes?

- Which areas are lower risk than expected because of land attributes?

- Which seemingly low-risk areas are more vulnerable than expected?

- Which collection of policies may require reinsurance coverage?

- Which cities offer the best opportunity for profitable growth?

- What is the expected probability, frequency or severity of each peril?

- What are the risk scores (1-10) for each policy in your portfolio?

Core components

- Hazard risk intelligence by address or coordinate

- Risk score on a 1-10 scale

- Risk attributes (e.g. historical probability, frequency & severity)

- Risk attributes vary by peril

- Perils include: earthquake, hail, hurricane wind & surge, ice storm, rainfall, tornado, wildfire, wind, winter storm, river and flash flood

- Roof hail damage risk score for provided parameters

- Hail and wind history reports by location

- 7-day forecast data

What’s your plan for managing catastrophe risk in a changing climate?

The increasing frequency and cost of natural disasters across the U.S. are forcing P&C insurers to handle an unprecedented volume of high-dollar property damage claims. Meanwhile, fraudulent property claims are increasing in both their volume and sophistication.

Reinsurance rates are rising and some policies even risk cancellation as more severe hurricanes, floods, convective storms and wildfires wreak havoc across the country. As climate change continues to bring more frequent and costly natural disasters, insurance carriers must reimagine their approach to forecasting and responding to catastrophes – before they affect the bottom line. Learn more in our insurance whitepaper.

Product support

Call (888) 320-7693 or email us at support@athenium.com

Let’s get started

Start a free trial, request pricing or speak with a member of the team.