Hazard risk analytics & weather intelligence for business

On-demand weather intelligence for mitigating risk & driving profit in a changing climate.

Manage asset risks, assess post-storm business impacts, risk-adjust financial instruments and enhance business continuity planning with hazard risk scoring & weather intelligence.

Assess business risk & protect assets with on-demand analytics across 11 natural hazards

Weather risk data solutions from Athenium Analytics provide the on-demand data your teams need to make faster, smarter decisions. Optimize portfolio risk, enhance logistics planning, protect critical infrastructure and build advanced risk & pricing models with peril-driven analytics. These curated weather intelligence bundles deliver insights right into your existing platforms and models, offering key benefits over traditional third-party tools, including:

- On-demand access to insights across your workflow

- Integration with your business, portfolio & pricing data

- Plug-and-play data feeds for advanced risk modeling

- Easy implementation with limited IT involvement

With convenient API access to our proprietary weather intelligence data, your teams can pull actionable, enterprise-driven risk insights when and where you need them.

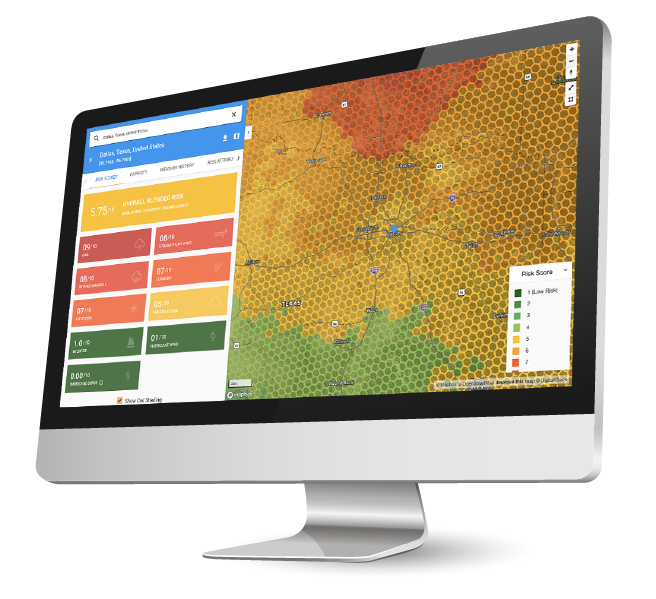

Hazard risk analytics

The hazard risk analytics API from Athenium Analytics bundles all the data and insights you need to make decisions around natural hazard & catastrophe risks to drive profits in a changing climate.

View hazard risk API

Weather forensics

The weather forensics data solution from Athenium Analytics bundles all the data and insights you need to identify at-risk assets, triage resources after a storm & protect your critical infrastructure.

View weather forensics API

Enterprise API

Looking to build a custom data solution tailored for your unique business needs? Learn more about our full suite of weather, property and business insights available on demand.

Request more information

Proprietary weather intelligence built on trillions of data points

distinct weather data sources, including weather stations, satellites, radars, buoys, aircraft and more.

historical and forecast weather variables available for enterprise-driven weather & climate risk analytics.

years of historical weather data that is cleansed, crunched & quality-checked to provide superior insights.

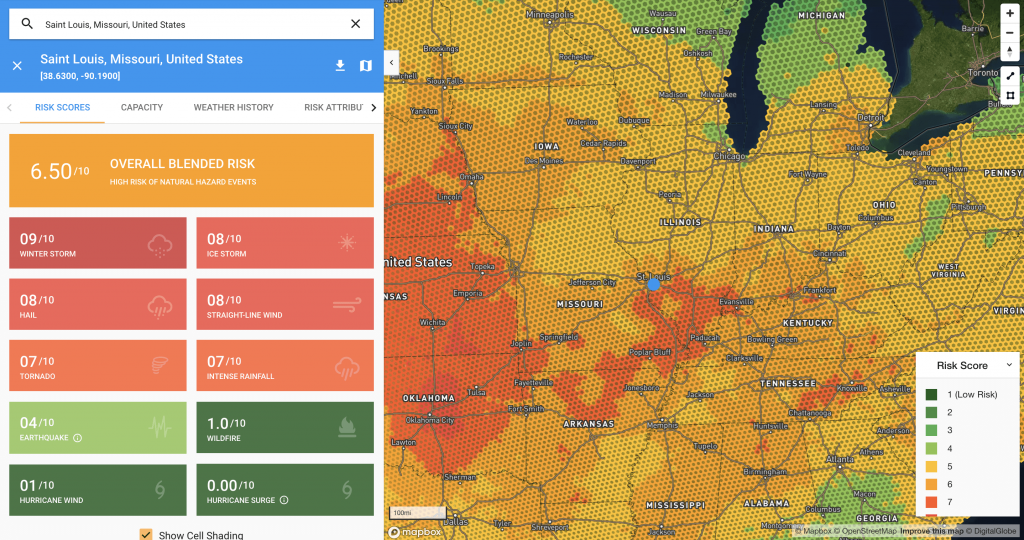

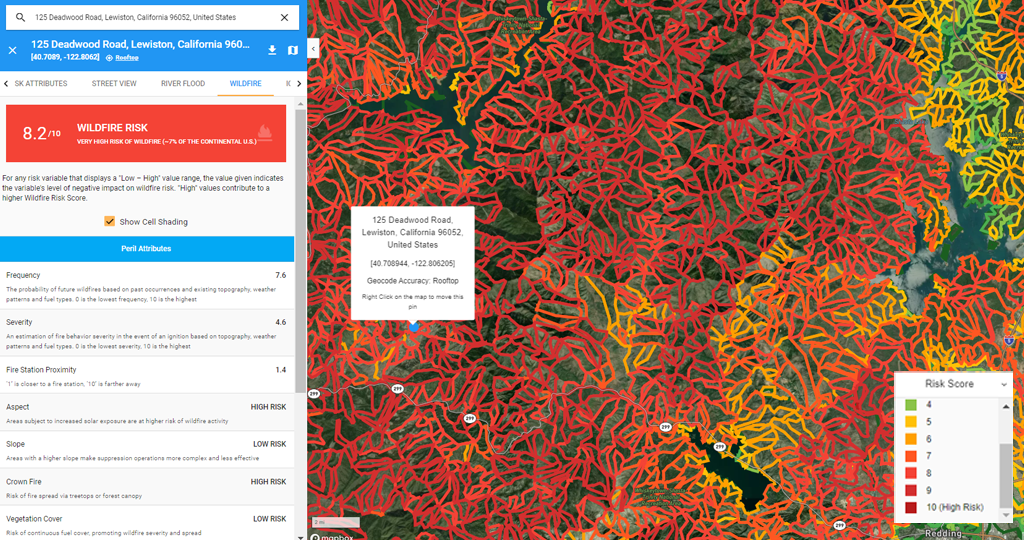

Hazard risk analytics data

Hazard risk analytics for property & asset risk assessment, financial instrument pricing & business continuity planning.

Assess property & asset risk

- Understand property- & portfolio-level risk for commercial & residential properties

- Assess property risk with separate & blended risk scores across 11 hazards

- Anticipate probable impacts of weather on critical physical infrastructure such as energy, agriculture & telecom

Inform financial instruments

- Assess natural hazard probability & severity to inform pricing & risk models for:

- Mortgage-backed securities

- Municipal bonds

- Catastrophe bond pricing

- Weather derivatives

Improve business continuity

- Understand hazard risk by location to prevent business disruptions that impact physical assets & equipment

- Maximize worker safety while in your facilities and traveling to remote locations

- Provide a single, on-demand risk intelligence engine across your business

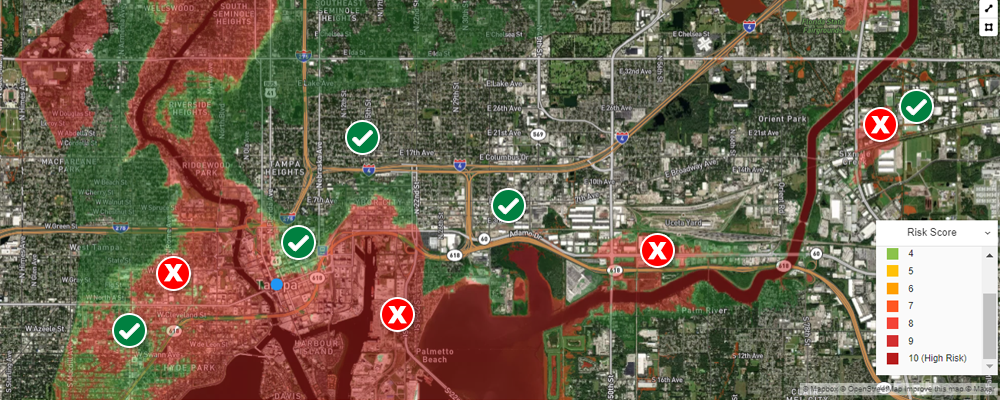

Managing business risk in Florida

- How vulnerable is existing energy infrastructure to climate change?

- Which regions are at risk for catastrophic floods or hurricanes?

- Will regional catastrophe risks influence mortgage underwriting rules?

- Which businesses are in need of disaster mitigation/planning?

- Which assets may require extra insurance or hazard coverage?

- Which cities offer the best opportunity for profitable growth?

Core components

- Hazard risk intelligence by address or coordinate

- Risk scores on a 1-10 scale

- Risk attributes (e.g. historical probability, frequency & severity)

- Risk attributes vary by peril

- Perils include: earthquake, hail, hurricane wind & surge, ice storm, rainfall, tornado, wildfire, wind, winter storm, river and flash flood

- Roof hail damage risk score for provided parameters

- Hail and wind history reports by location

- 7-day forecast data

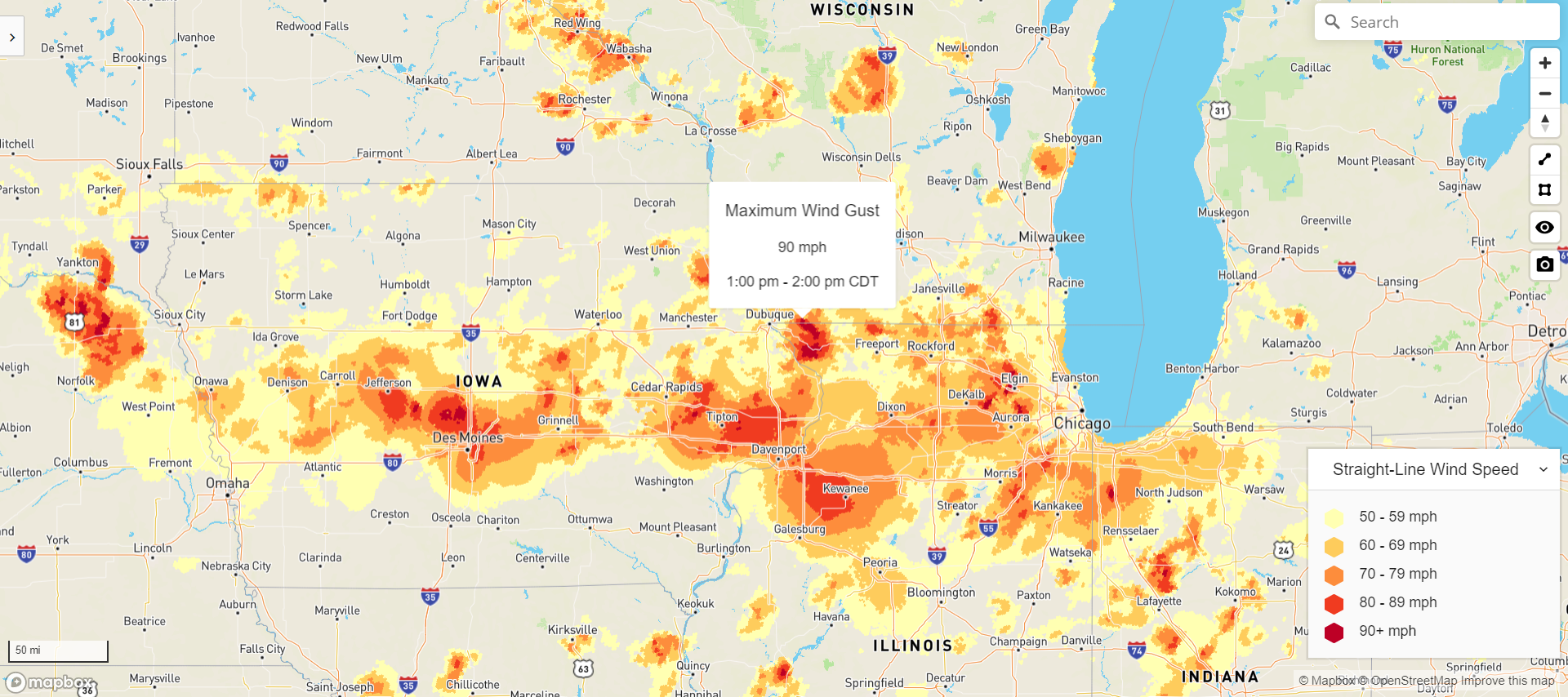

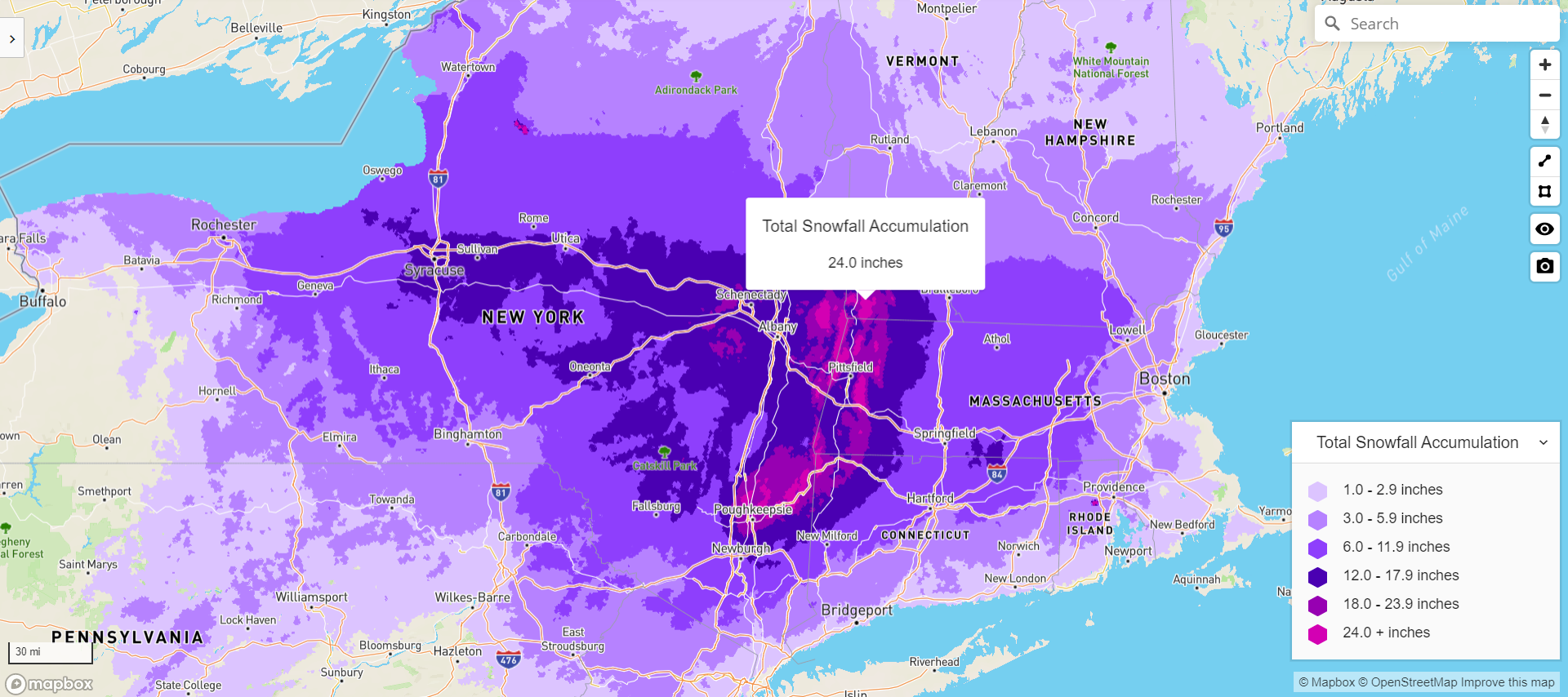

Post-event forensics intelligence

Quickly identify, assess & address at-risk properties, physical assets & infrastructure after severe weather events with high-resolution post-hazard analytics.

Identify impacted assets

- Access high-resolution storm data across 8 perils, including hail, wind & precipitation

- Model how this weather event may impact supply, demand and prices for traditional & renewable energy sources

- Analyze the impact on supply (and prices) of critical commodities like wheat and corn

Inform trading strategies

- Assess which mortgage-backed securities are at higher risk of default due to a concentration of impacted properties

- Determine municipal bond default rates based on the latest storm footprints

- Quickly adjust equity trading strategies for weather-impacted businesses and verticals (e.g., retail, construction, insurance)

Assess operational impacts

- Understand the effect of severe weather on construction projects

- Help local corporations assess business interruptions and build continuity plans

- Pull instant insights within your existing construction project or business continuity management platforms

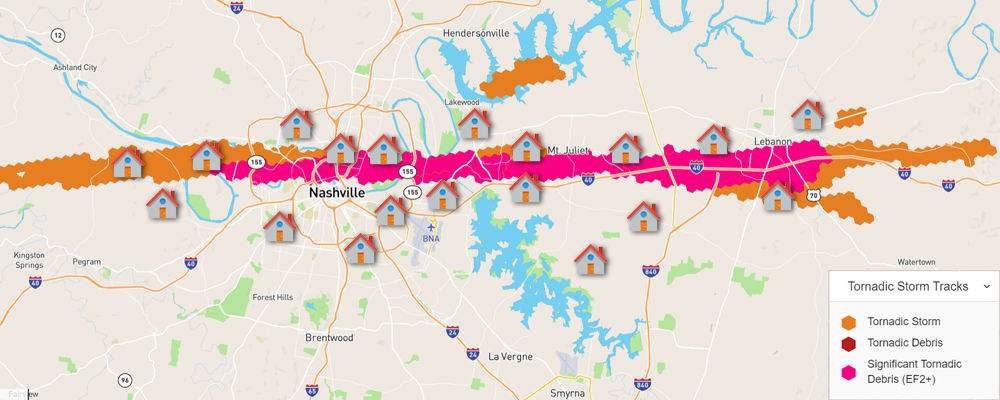

Assessing tornado impacts on local assets

- Which residential & industrial properties were in the tornado’s path?

- Was any critical energy infrastructure impacted, resulting in material changes in supply?

- Is the impact on residential properties broad and severe enough that mortgage delinquency rates could be affected?

- Did the tornado impact areas such that crop supplies are at risk?

- Are local businesses at risk of a significant business interruption, requiring continuity planning?

Core components

- Hyperlocal weather verification by location and peril

- Perils include: hail, wind, rain, snow, sleet & tornadic storm

- High-resolution storm data available within 90 minutes

- Hour-by-hour weather data at 1km resolution

- Geospatial storm contours by peril & date (geojson or kml)

- SPC wind, hail & tornado observational data

- Hail & wind history reports by location

- 7-day forecast data

- Proprietary, patent-pending algorithms to curate, QC & normalize datasets in real-time

Visualize weather forensics data in your preferred mapping tool

What’s your plan for managing catastrophe risk in a changing climate?

The increasing frequency and cost of natural disasters across the U.S. are forcing real estate investors, financial institutions and other businesses to manage an unprecedented amount of risk in every region across the country. The threat of severe weather on business continuity, property, logistics and profitability is pushing forward-looking organizations to find better tools to plan for and respond to natural hazard events.

These growing risks are especially relevant for P&C insurance carriers: reinsurance rates are rising and some policies even risk cancellation as hurricanes, floods and wildfires wreak havoc across the country. Discover how insurers are reimagining their approach to natural catastrophes and what tools are available to enterprise organizations to address these challenges. Learn more in our billion-dollar storms whitepaper.

Product support

Call (888) 320-7693 or email us at support@athenium.com

Let’s get started

Start a free trial, request pricing or speak with a member of the team.